Welcome to Sneakers Insider – FREE Version

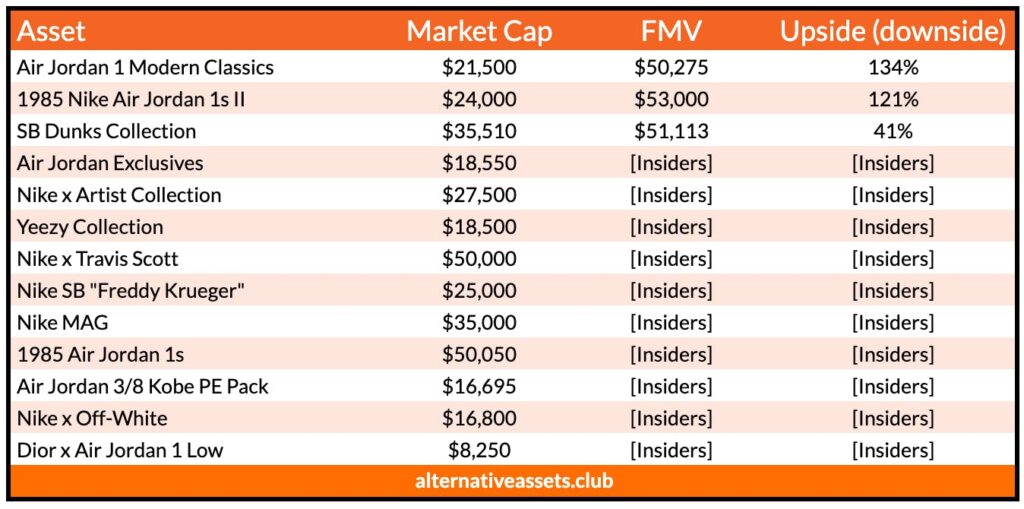

We use Moneyball tactics to discover sneaker arbitrage opportunities across the fractional platforms.

Note: Sneaker markets trade thinly and there typically aren’t any catalysts to cause the share price to snap to fair market value. So: (a) the assets could stay mispriced for a long time, (b) there may not be sufficient trading volume to sell all the shares you want to when you want to.

All data taken from the most recent sales on StockX.

Table of Contents

Sneaker Arbitrage Opportunities

Every Monday, we compare the market cap for sneakers on the Otis platform to the inferred value based on recent sales on sneaker trading platform StockX.

Upcoming Profitable Sneaker Drops

It’s a rare occasion when the resale value of hyped sneakers goes north of $1000, which typically means a 5x + return on their average resale value of around $200.

November happens to have two opportunities on the same day for a shoe with extraordinary returns.

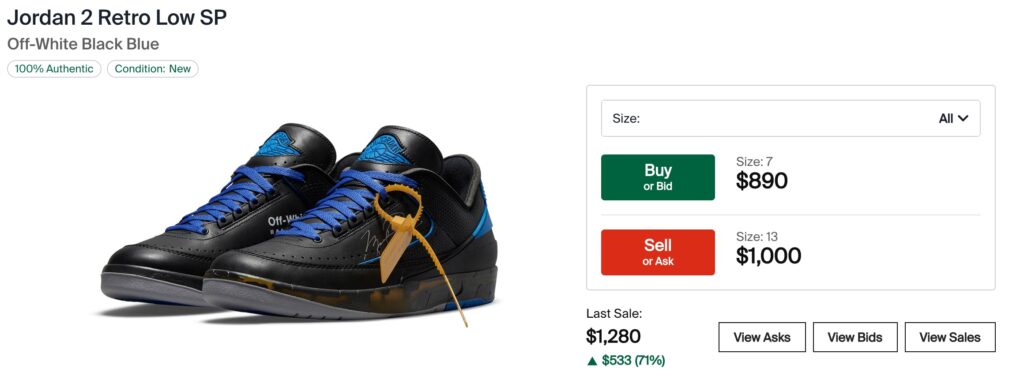

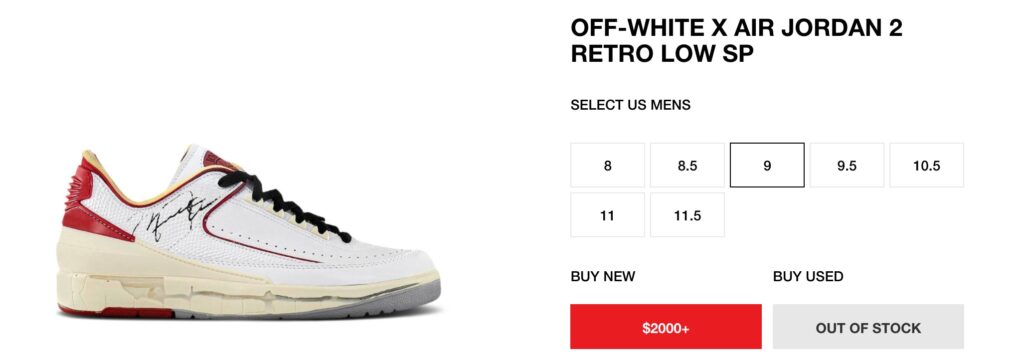

Off-White, a high end streetwear brand, is collaborating with Jordan with their Retro 2 at a retail price of $250 and an estimated resale value of $1000-$2000 depending on size and color.

Previous releases on Stockx

Previous releases on Flight Club

StockX and Flight Club are two top sneaker reselling platforms, with bidders paying up early to secure pairs of these coveted sneakers.

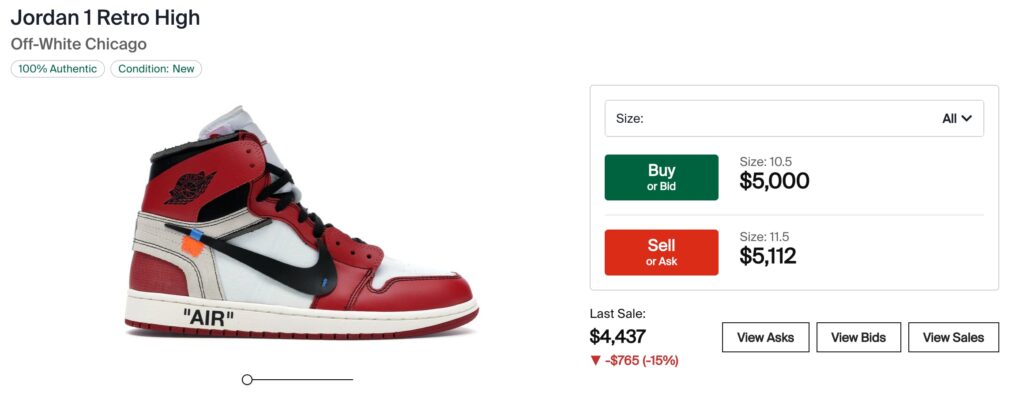

Historically, some Off White Jordans have appreciated on top of their already sky high initial resale value, sometimes by insane amounts:

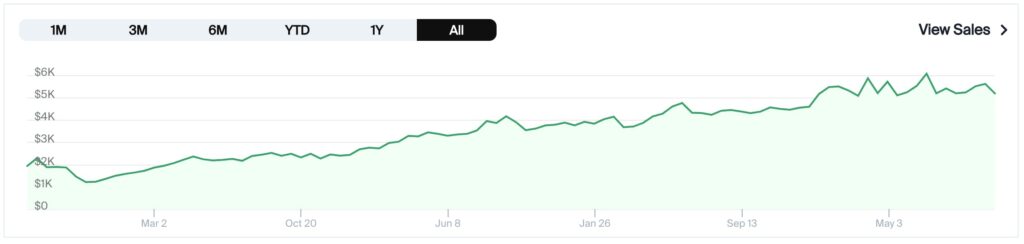

The Air Jordan 1 Chicago Off-White released in 2017 for $190 and instantly 10x’d , consistently selling at $1800-$2000 on the resale market.

Prices of the model continued to appreciate over the years to a now $5000-$7000+ per pair, with the most significant rise between 2017-2019

Sneaker collectors and flippers use a specialized combination of techniques in addition to a bit of luck to get these shoes for retail, but even if you miss out on the release price you can still capitalize on the appreciation of these wearable assets.

This section has been created in partnership with Six Figure Sneakerhead.

Six Figure Sneakerhead. was created as the top resource for sneaker resale education for those who want to learn all there is to know about the underground yet lucrative multi billion dollar sneaker resale market.

Their site includes resources & a free in-depth blog that you can use to tap into the latest sneaker news. Check it out.